Local Market Update – April 2023

Spring has truly arrived in our region, with longer days and blooming cherry blossoms. Along with these harbingers of the season, the pace of the local real estate market has also picked up, indicating that the spring market is finally here. An uptick in new listings and price gains in the last month demonstrates a typical seasonal pattern, and buyers and sellers are adjusting their strategies accordingly.

According to Windermere’s Chief Economist Matthew Gardner, the total inventory in King, Snohomish and Pierce counties grew over 14% from February. However, the number of homes for sale in the tri-county area was down about 40% when compared to pre-pandemic stats from March 2019. This gives sellers the advantage when it comes to setting prices for their listings.

Gardner noted this as well. “Despite the growing number of available homes for sale, sellers in King County are holding firm, with listing prices increasing by over 5% compared to February. In Snohomish County, listing prices were up just shy of 5%,” he said.

While the monthly increase in listings is good news for buyers, fluctuating interest rates and steadfast prices from sellers mean some borrowers are getting creative with their financing. Bridge loans, home equity loans and purchases contingent on the sale of the buyer’s previous home are coming back into circulation.

These factors and more are that buyers are eager to take advantage of the market when interest rates dip down to more comfortable levels. As rates continue to fluctuate and gradually level off, prices may once again become the major determining factor for which listing a buyer may pursue.

In King County, the median price for a single-family home rose about 4.8% from $800,000 in February to $840,000 last month. While that’s still down 9.68% from the median price of $930,000 in March 2022, steady price growth in the face of higher interest rates is certainly notable. With about one month of inventory, the ball is still in the sellers’ court, despite lower year-over-year prices.

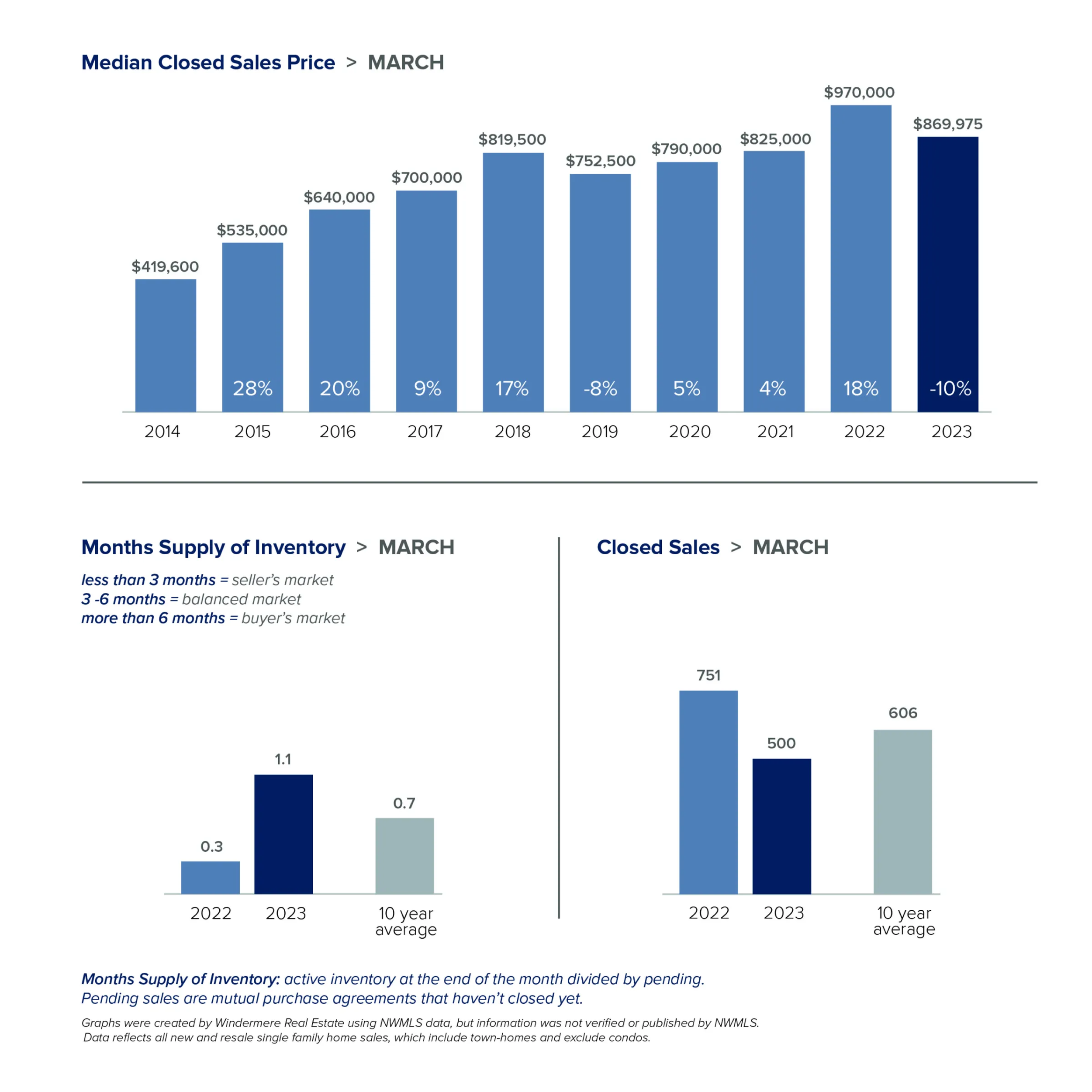

Seattle followed a similar pattern. The median price for single-family homes dropped 10.3% from $970,000 in March 2022 to $869,975 last month. However, that’s an increase of over 5% from February’s median price of $825,000. The condo market saw year-over-year gains of 4.9%, increasing from a median price of $510,025 in March 2022 to $535,000 last month. The residential market still had relatively tight inventory at about 1.1 month’s supply. However, when compared to the scant .3 month’s supply of March 2022, buyers seem to have their pick of listings.

The Eastside saw the greatest year-over-year price decrease, which is to be expected considering the already high price point of the area. While the median single-family home price decreased almost 17% from $1,700,000 in March 2022 to $1,411,500 last month, the area did see monthly gains; the median price increased just over 5% from $1,340,000 in February. Condos in the area also had monthly increases, from a median price of $540,000 in February to $585,000 last month.

Snohomish County — while still more affordable than its neighbors — was also up compared to February. Last month, the median price for single family homes in the area was $724,000, up from $690,560 in February. The area had the smallest relative year-over-year price decrease of 9.5%, coming down from a median of $800,000 in March 2022. With just .8 months of inventory, Snohomish is still a desirable area for buyers looking to get the most bang for their buck.

Over the last few weeks, tapering interest rates have brought buyers back to the market, but low inventory remains a key challenge for prospective buyers moving forward. If you’d like to learn more about what these market conditions mean for you, please reach out to your Windermere broker.

Eastside

King County

Seattle

Snohomish County

This post originally appeared on GetTheWReport.com